The Compliance Management Tech Revolution

How advancements in technology are reshaping the compliance landscape

There is a quiet revolution going on in the compliance departments of banks and financial institutions all over the world. The latest technology advancements in compliance management are allowing companies to become faster and better at compliance than it was ever before.

This revolution isn’t unlike the other tech revolutions we went through. It began with companies adapting email in the 80s and 90s, to ERP systems in the 90s and 00s, to e-commerce becoming commonplace in the 00s and 10. Thanks to advancements in artificial intelligence computers can now help organizations manage compliance and regulatory change as well.

These compliance management solutions manage every aspect of compliance; thus, their effects aren’t limited to just a single factor. They are changing multiple facets of compliance and are redefining the compliance status quo.

Administrative and menial tasks are getting automated

Compliance management systems have completely overtaken the most frustrating part of managing compliance; the administrative and menial tasks. Managing compliance means dealing with hundreds of documents, multiple spreadsheets, getting involved in many different conversations, and there are many different versions of the same file. All of this is consolidated within the system, which allows compliance professionals to focus more on compliance.

Compliance management systems automatically schedule recurring tasks, notify management and employees when tasks are due and are always vigilantly monitoring the compliance framework. These systems map the relationships between compliance needs, regulations, documents, policies, rules, and much more. This automates many parts of a compliance officer’s job – the most basic one of them being discovering compliance conflicts. Since everything is mapped in the system, a change in any part of the system automatically notifies users that everything linked to that part needs to be looked at.

The job role of compliance officers is changing

Since compliance management systems allow compliance officers and managers to truly focus on compliance their job role is also changing. Instead of just maintaining the current compliance status quo and putting out small fires, they can undertake big and transformative compliance projects. This makes their job not just more productive, but more fulfilling as well.

Since compliance management systems map out the relationship between regulations, documents, policies, rules, spreadsheets, and other compliance items, it is easy to undertake bigger projects as well. It is easy to see what changes will affect how much of the current compliance infrastructure, and what may be bottle-necking the efficiency of the compliance department. Instead of having to create reports, find relevant documents, and finding ways to collaborate on everything, it is all handled by the compliance management system. Compliance managers and officers instead spend their time coming up with plans to improve compliance levels.

The first line of defense is getting stronger

Risk and compliance officers are the 2nd line of defense – the first line of defense are the people directly interacting with clients. From filling KYC forms to judging compliance issues quickly, these people need better tools to be compliant. In an organization where compliance is managed manually, this simply is not possible. Front-end employees do get training for compliance and risk, but often the work is so cumbersome that they end up making mistakes.

Compliance management technology changes the game by making compliance management convenient. Instead of creating and managing documents, people can directly work within compliance management systems. If a conflict arises they do not have to wait for their managers to catch it and highlight it to them – many problems are automatically detected by these systems, which ensures that compliance is also being managed at the first line of defense. As a result, many issues that may have been detected months later in an audit are instead dealt with instantaneously.

Upper management is getting a holistic view of compliance

When compliance is being managed manually, upper management is only aware of the issues that have been brought up to them. This creates a major blind spot for upper management because they are dependent completely on the information that has been brought to them. Compliance management technology fixes this problem by bringing executive dashboards to the world of compliance.

These executive dashboards show upper management a holistic view of compliance. When they logon to the compliance management system, they are presented with a screen which tells them about the compliance status of the organization. Important information is automatically displayed on the dashboard. Tasks that are due soon are prioritized. Compliance issues and conflicts are also highlighted.

This gives upper management unparalleled access and insight into compliance management. They are always aware of how the company is performing when it comes to compliance and if there is something which needs their attention immediately. They no longer wait for an issue to be reported to them – instead, they see the issues presented to them in the system and they can tag employees in the compliance management system and assign them to issues that need to be fixed.

Compliance management technology is becoming a competitive advantage

One of the biggest advantages of compliances management technology is that it becomes a huge competitive advantage against organizations that are still managing compliance manually. Service delivery becomes quicker and more effective. The presence of a compliance management system allows compliance managers and officers to solve issues quicker and deliver results to clients faster than the competition.

In today’s dynamic business environment, the most agile business ends up winning, and the agility offered by compliance management technology is unparalleled. The most exciting part of the compliance management revolution is that it has reached the maturity stage. It has been more than a decade since the first few solutions came out – the solutions that are coming now are much more capable. There are no risks of using an untested technology for organizations. There is a lot of variety in the market as well, from systems developed by legacy vendors for big businesses to simpler systems developed for smaller businesses. If your business wants to compete in compliance, it is imperative that it starts looking for appropriate compliance management solutions.

Similar Articles

In 2026, Microsoft Excel continues to power the U.S. business ecosystem, supporting over 80% of financial modeling, 70% of operational reporting, and nearly 65% of analyst-driven decision workflows across enterprises.

The rapidly growing volume and speed of digital transactions have had a whole lot of implications for businesses

We live in the age of cloud computing. That's plain to see. However, what may escape many are the operational and financial challenges of managing multiple independent clusters.

Times have changed and how! Take modern technology and the fast-paced digital economy, it is driving. Given the market conditions, any company's infrastructure has become more than just a technical detail.

It has been for everyone to see that the modern digital economy is distinguished by high volume, real-time financial transactions.

Business success has become reliant on efficiency and agility of the underlying technology infrastructure. Clearly, companies now depend on cloud computing to provide seamless services while managing exponential data growth.

Hospitals operate in environments where availability and patient safety are paramount at all times. As medical supply chains expand and regulatory oversight becomes more demanding, manual tracking methods introduce delays and risk.

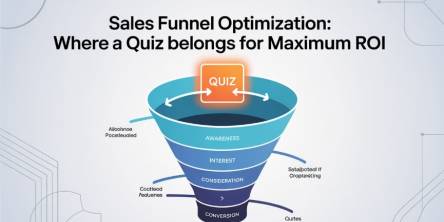

Every sales funnel has one core goal: turn attention into revenue as efficiently as possible. Yet many funnels leak value at critical stages—visitors bounce, leads go cold, and sales teams chase prospects who were never a good fit.

Decentralized Finance (DeFi) has transformed how users earn passive income through blockchain-based financial systems. Among its most popular use cases,